10 ESSENTIAL BOOKKEEPING TIPS FOR START-UPS AND ENTREPRENEURS

As a start-up or entrepreneur, managing your finances effectively is crucial for the success and growth of your business. Bookkeeping is an essential aspect of financial management that helps you track your income, expenses, and cash flow. In this article, we’ll provide you with essential bookkeeping tips for start-ups and entrepreneurs.

What is Bookkeeping?

Bookkeeping is the process of recording, classifying, and reporting financial transactions of a business. It involves the systematic and accurate recording of financial data, such as income, expenses, assets, liabilities, and equity.

Bookkeeping is also an essential function of accounting, as it provides the foundation for preparing financial statements, such as balance sheets, income statements, and cash flow statements. These financial statements are used to make informed business decisions, secure funding, and comply with tax regulations.

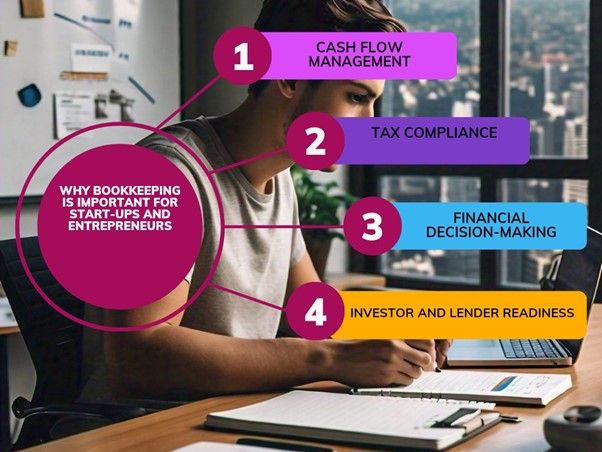

Why Bookkeeping is Important for Start-ups and Entrepreneurs

Before we dive into the bookkeeping tips, let’s discuss why bookkeeping is important for start-ups and entrepreneurs:

1. Cash flow management: Bookkeeping helps you track your cash inflows and outflows, ensuring you have enough funds to meet your financial obligations.

2. Tax compliance: Accurate bookkeeping ensures you’re meeting your tax obligations, avoiding penalties and fines.

3. Financial decision-making: Bookkeeping provides you with accurate financial data, enabling you to make informed decisions about your business.

4. Investor and lender readiness: Well-maintained books can help you secure funding from investors or lenders.

Essential Bookkeeping Tips for Start-ups and Entrepreneurs

Here are the essential bookkeeping tips for start-ups and entrepreneurs:

1. Separate Personal and Business Finances

Keep your personal and business finances separate by opening a business bank account. This will help you avoid commingling funds and make it easier to track business expenses.

2. Choose an Accounting Method

Select an accounting method that suits your business needs. You can choose from:

- Cash basis accounting: Records transactions when cash is exchanged.

- Accrual basis accounting: Records transactions when earned, regardless of when cash is exchanged.

3. Set Up a Chart of Accounts

Create a chart of accounts to categorize your business transactions. This will help you track expenses, income, and assets.

4. Track Expenses

Record all business expenses, including:

- Fixed expenses: Rent, utilities, salaries.

- Variable expenses: Supplies, travel, marketing.

- Capital expenditures: Equipment, property, investments.

5. Manage Accounts Receivable and Payable

Track accounts receivable (income owed to your business) and accounts payable (expenses owed by your business).

6. Reconcile Bank Statements

Regularly reconcile your bank statements to ensure accuracy and detect any discrepancies.

7. Prepare Financial Statements

Generate financial statements, including:

- Balance sheet: Snapshots your business’s financial position.

- Income statement: Shows your business’s revenues and expenses.

- Cash flow statement: Tracks your business’s cash inflows and outflows.

8. Stay Organized and Up-to-Date

Use cloud-based accounting software, such as QuickBooks or Xero, to stay organized and up-to-date.

9. Seek Professional Help

Consult with a bookkeeper or accountant to ensure your books are accurate and compliant with tax regulations.

10. Review and Adjust

Regularly review your financial statements and adjust your bookkeeping practices as needed.

Conclusion

Bookkeeping is a critical aspect of financial management for start-ups and entrepreneurs. By following these essential bookkeeping tips, you’ll be able to track your finances accurately, make informed decisions, and drive business growth.

Frequently Asked Questions

Q: What is the best accounting software for start-ups?

A: Cloud-based accounting software like QuickBooks, Xero, or Wave are popular choices for start-ups.

Q: How often should I reconcile my bank statements?

A: It’s recommended to reconcile your bank statements monthly to ensure accuracy and detect any discrepancies.

Q: Can I do my own bookkeeping, or do I need to hire a professional?

A: While you can do your own bookkeeping, it’s recommended to consult with a bookkeeper or accountant to ensure accuracy and compliance with tax regulations.

Key Takeaways

- Separate personal and business finances

- Choose an accounting method

- Set up a chart of accounts

- Track expenses

- Manage accounts receivable and payable

- Reconcile bank statements

- Prepare financial statements

- Stay organized and up-to-date

- Seek professional help

- Review and adjust