HOW TO HANDLE AN AUDIT: A TAX ACCOUNTANT’S PERSPECTIVE

As a business owner or individual in Canada, receiving a notice of audit from the Canada Revenue Agency (CRA) can be a stressful and intimidating experience. However, with the right guidance and preparation, you can navigate the audit process with confidence. In this blog, we’ll provide a comprehensive guide on how to handle an audit from a tax accountant’s perspective. Whether you’re a seasoned entrepreneur or an individual taxpayer, this information is crucial for ensuring a smooth and successful audit process.

Understanding the Audit Process

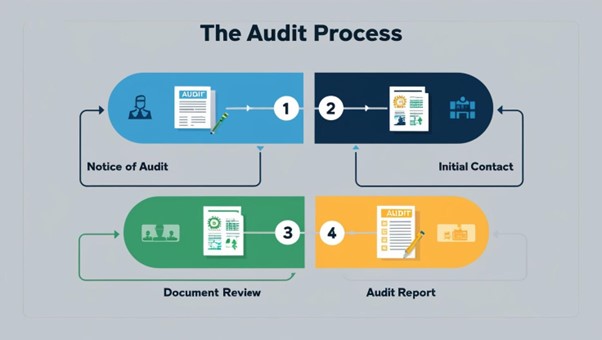

Before we dive into the nitty-gritty of handling an audit, it’s essential to understand the audit process itself. Here are the key steps involved:

- Notice of Audit: The CRA will send you a notice of audit, outlining the scope and purpose of the audit.

- Initial Contact: The auditor will contact you to introduce themselves, explain the audit process, and request documentation.

- Document Review: The auditor will review your financial records, tax returns, and other documentation to identify any discrepancies or issues.

- Audit Report: The auditor will issue an audit report outlining their findings, any adjustments, and proposed penalties.

PREPARING FOR AN AUDIT

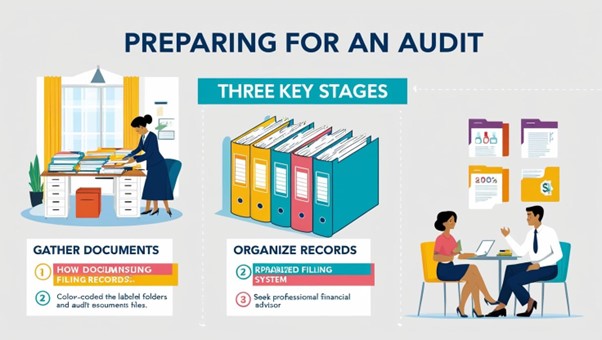

To ensure a successful audit process, it’s crucial to be prepared. Here are some key steps to take:

- Gather Documentation: Collect all relevant financial records, tax returns, and other documentation requested by the auditor.

- Organize Records: Organize your records in a clear and concise manner, making it easy for the auditor to review.

- Seek Professional Advice: Consult with a Canada tax expert or financial advisor in Ontario to ensure you’re properly prepared and represented.

HANDLING THE AUDIT PROCESS

During the audit process, it’s essential to remain calm, cooperative, and professional. Here are some key tips to keep in mind:

- Be Responsive: Respond promptly to the auditor’s requests for documentation and information.

- Be Transparent: Be open and transparent about your financial records and tax returns.

- Be Respectful: Treat the auditor with respect and professionalism, even if you disagree with their findings.

RESOLVING AUDIT ISSUES

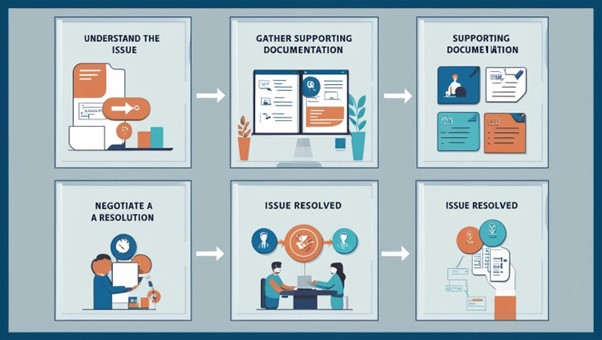

If the auditor identifies any issues or discrepancies during the audit process, it’s essential to address them promptly and professionally. Here are some key steps to take:

- Understand the Issue: Clearly understand the issue or discrepancy identified by the auditor.

- Gather Supporting Documentation: Collect any supporting documentation or evidence to resolve the issue.

- Negotiate a Resolution: Work with the auditor to negotiate a resolution, which may involve paying additional taxes, penalties, or interest.

ADDITIONAL TIPS

- Request an Extension If Needed: If you require more time to gather the necessary documents, you can request an extension from the CRA. While they may grant an extension in some cases, it’s crucial to communicate your request promptly and explain the reason for the delay.

- Review the Findings: Once the audit or review is complete, the CRA will provide you with their findings. Review the assessment carefully and seek clarification if you have questions or disagree with the conclusions. If necessary, you can file an objection.

- File an Objection if Appropriate: If you believe the CRA’s assessment is incorrect, you have the right to file an objection. This involves submitting a formal request for a review of the assessment. Be sure to follow the specific guidelines outlined by the CRA for the objection process.

- Maintain Compliance Going Forward: To reduce the likelihood of future audits or reviews, ensure ongoing compliance with tax laws and regulations. Stay informed about tax changes and consult with a tax professional to optimize your tax strategy.

CONCLUSION

Handling an audit can be a stressful and intimidating experience, but with the right guidance and preparation, you can navigate the process with confidence. By understanding the audit process, preparing for an audit, handling the audit process, and resolving audit issues, you can ensure a successful outcome. Remember to seek professional advice from a Canada tax expert or financial advisor in Ontario in Ontario to ensure you’re properly prepared and represented.

FOR CONSULTATION

If you’ve received a notice of audit or are concerned about an upcoming audit, consult with our team of experts. We’ll provide guidance and support to ensure a successful audit process.

Contact Us

Phone: (647)643-1095

Email: sjohn@glhaccounting.ca

Address: G.L.H. Accounting Services 105 Hansen Rd N, Brampton, ON L6V 3C9..

Follow Us

Instagram: GLHACCOUNTING

LinkedIn: glhaccounting

By seeking professional advice and being prepared, you can minimize the stress and uncertainty of an audit. Consult us today and take the first step towards a successful audit process.

ABOUT AUTHOR

Shanel John is a dedicated Certified Public Accountant (CPA) at G.L.H. Accounting, specializing in Income Tax with 10 years of experience. Based in Brampton, Ontario, Canada, Shanel offers expertise in tax preparation, financial accounting, and advisory services. A certified QBO Pro Advisor, Shanel’s decade-long experience and knowledge make her a trusted figure in the accounting field.